The logistics industry in the Philippines is very important to the economy since it makes trade, e-commerce, and distribution across the country possible. Yet, the country has long struggled with bottlenecks such as congested ports, high shipping costs, and fragmented infrastructure.

According to the World Bank’s 2023 Logistics Performance Index, the Philippines’ economy ranked 43rd out of 139, which is better than it was in prior years but still lower than Malaysia’s and Thailand’s. The good news is that infrastructure developments, governmental and private sector investments, and digital innovations are beginning to strengthen and increase the industry’s competitiveness.

What is Driving the Logistics Transformation?

The Philippine logistics industry is undergoing a structural logistics transformation, influenced by multiple global and domestic forces.

E-commerce expansion

The Department of Trade and Industry (DTI) projects the Philippine e-commerce sector could reach ₱1 trillion in gross merchandise value by 2025.

Build Better More Program

The Marcos government is still putting money into infrastructure, with a focus on highways, ports, and airports.

ASEAN integration

Regional trade agreements demand faster and more efficient cross-border logistics transformation.

Digital adoption: Startups like Transportify, Lalamove, and Grab Express are reshaping last-mile delivery capabilities.

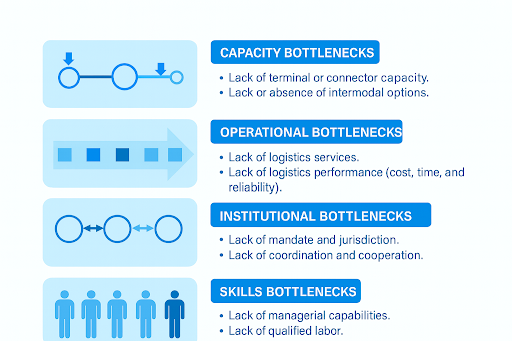

What Are the Main Bottlenecks Facing the Industry?

Port Congestion and High Costs

The Port of Manila handles over 75% of container traffic, creating chronic congestion. This causes truck turnaround times to double compared to regional hubs like Singapore. The Philippine Competition Commission has also noted high domestic shipping costs due to limited competition.

Fragmented Road and Transport Infrastructure

The Philippines has some of the highest logistics expenses in Asia, accounting for up to 27% of business sales (Asian Development Bank, 2022). These expenses are caused by poor connection between provinces and islands.

Regulatory and Customs Delays

Clearance durations still average 7–10 days, but in Vietnam they are only 1-2 days, even though the Bureau of Customs is digitizing its procedures.

Breakthroughs Reshaping Philippine Logistics

Infrastructure Development

The following projects are part of the government’s Build Better More initiative:

- North-South Commuter Railway (possibility of rail freight)

- Cavite-Laguna Expressway (CALAX) improving connectivity for industrial zones

- Expansion of Clark International Airport as a logistics hub

Digitalization and Smart Logistics

Philippine Economic Zone Authority (PEZA) promotes end-to-end digital platforms for supply chain transparency.

Companies like 2GO Group and AirAsia Logistics are investing in tracking technologies and warehousing automation.

Green and Sustainable Logistics

There is growing adoption of electric delivery vehicles and solar-powered warehouses to align with the Philippines’ 2050 net-zero carbon goals.

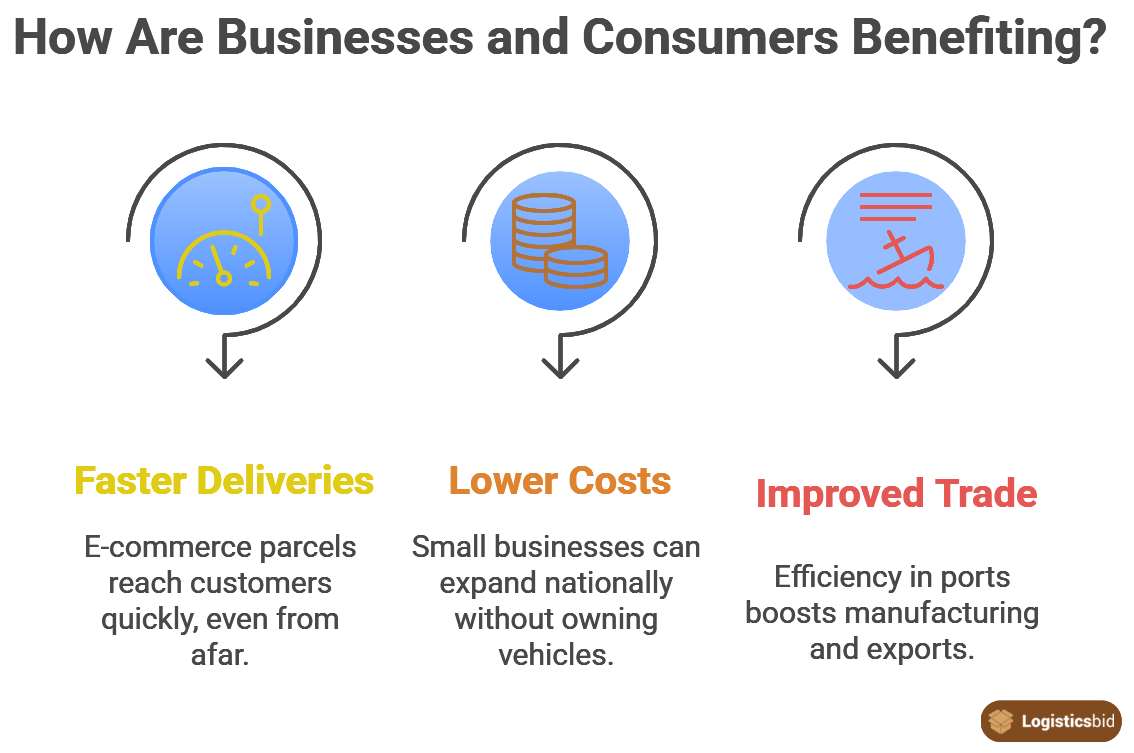

How Are Businesses and Consumers Benefiting?

1. Faster Deliveries

Even from provincial warehouses, e-commerce packages can reach Metro Manila customers in 24 to 48 hours thanks to logistics technology platforms.

2. Lower Costs for SMEs

Aggregated courier services make it possible for small businesses to scale nationally without owning fleets.

3. Improved Global Trade

Increased efficiency in ports and airports enhances the Philippines’ competitiveness in manufacturing and exports.

Comparison: Logistics Landscape in Southeast Asia

| Country | Logistics Cost as % of GDP | Customs Clearance (Avg. Days) | LPI 2025 Ranking |

|---|---|---|---|

| Philippines | 27% | 7–10 days | 43rd |

| Vietnam | 16–18% | 1–2 days | 43rd (tie but higher efficiency) |

| Malaysia | 13% | 1–2 days | 26th |

| Singapore | 8% | <1 day | 1st |

What Do These Changes Mean for Logistics Players?

The logistics transformation is not just a macroeconomic story, it directly affects logistics service providers, e-commerce platforms, manufacturers, and SMEs that rely on efficient supply chains. Each player in the ecosystem stands to benefit differently, but they also face new responsibilities as they adapt to change.

Logistics Providers: Adapting to Digital-first Operations

To stay competitive, freight forwarders and third-party logistics companies (3PLs) need to use digital customer platforms, automation, and AI-driven route optimization. Companies like LBC, 2GO, and DHL Philippines have already integrated end-to-end tracking and flexible last-mile delivery solutions to meet fast-rising e-commerce demand.

- Opportunity: Make a difference by using sustainable practices, data-driven transparency, and dependability.

- Challenge: High capital requirements for automation and green logistics fleets.

E-Commerce Platforms: Faster, Smarter Supply Chains

E-commerce players like Shopee, Lazada, and Zalora rely heavily on express and last-mile logistics. Their growth hinges on cost-efficient fulfillment centers and stronger partnerships with logistics operators.

- Opportunity: Use localized warehouses to reduce delivery times from 5–7 days to under 48 hours.

- Challenge: Balancing low-cost delivery expectations with rising logistics expenses.

SMEs and Manufacturers: Scaling with Cost Efficiency

Small and medium enterprises face the highest logistics costs relative to revenues. With recent breakthroughs, SMEs can access consolidated courier services at scale, especially through logistics marketplaces.

- Opportunity: Tech enables SMEs to reach nationwide customers without owning their own fleets.

- Challenge: Digital adaptation and integration with online logistics platforms.

Investors and Policymakers: Enabling a Regional Gateway

Private equity and infrastructure investors are increasingly looking at the Philippines for logistics parks, cold chain facilities, and digital freight solutions. At the same time, policymakers, particularly the Department of Transportation (DOTr) and Philippine Economic Zone Authority (PEZA), are focusing on building globally competitive logistics hubs to support ASEAN trade integration.

- Opportunity: Position the Philippines as a major distribution hub between East Asia and ASEAN.

- Challenge: Policy consistency and inter-agency coordination remain critical.

Logistics as a Strategic Enabler

As logistics advances, it ceases to be a support function and instead turns into a strategic instrument that enables competition among all ecosystem actors. Reliable, transparent, and cost-effective supply chains reduce operational risk, enhance customer satisfaction, and unlock new growth channels domestically and internationally.

For logistics players, the future is not only about moving goods, it’s about moving ahead with innovation, collaboration, and sustainable growth.

The Philippine logistics industry is evolving from a historically fragmented, high-cost system into a more connected, tech-driven ecosystem. Even while there are still constraints, particularly in port operations and rural connectivity, the industry is poised for revolutionary expansion thanks to the combined effects of public infrastructure investments, digital logistics innovation, and global trade integration. For businesses, logistics is no longer just a cost factor, it is a strategic enabler of competitiveness in both domestic and global markets.