Digital services have revolutionized how consumers access entertainment, education, and essential software tools. In the Philippines, the introduction of a 12% value-added tax (VAT) on digital services has significant implications for both consumers and providers. As foreign digital companies are now required to collect this tax, understanding the impact of digital service VAT on all stakeholders becomes crucial.

What is the 12% VAT on Digital Services?

|

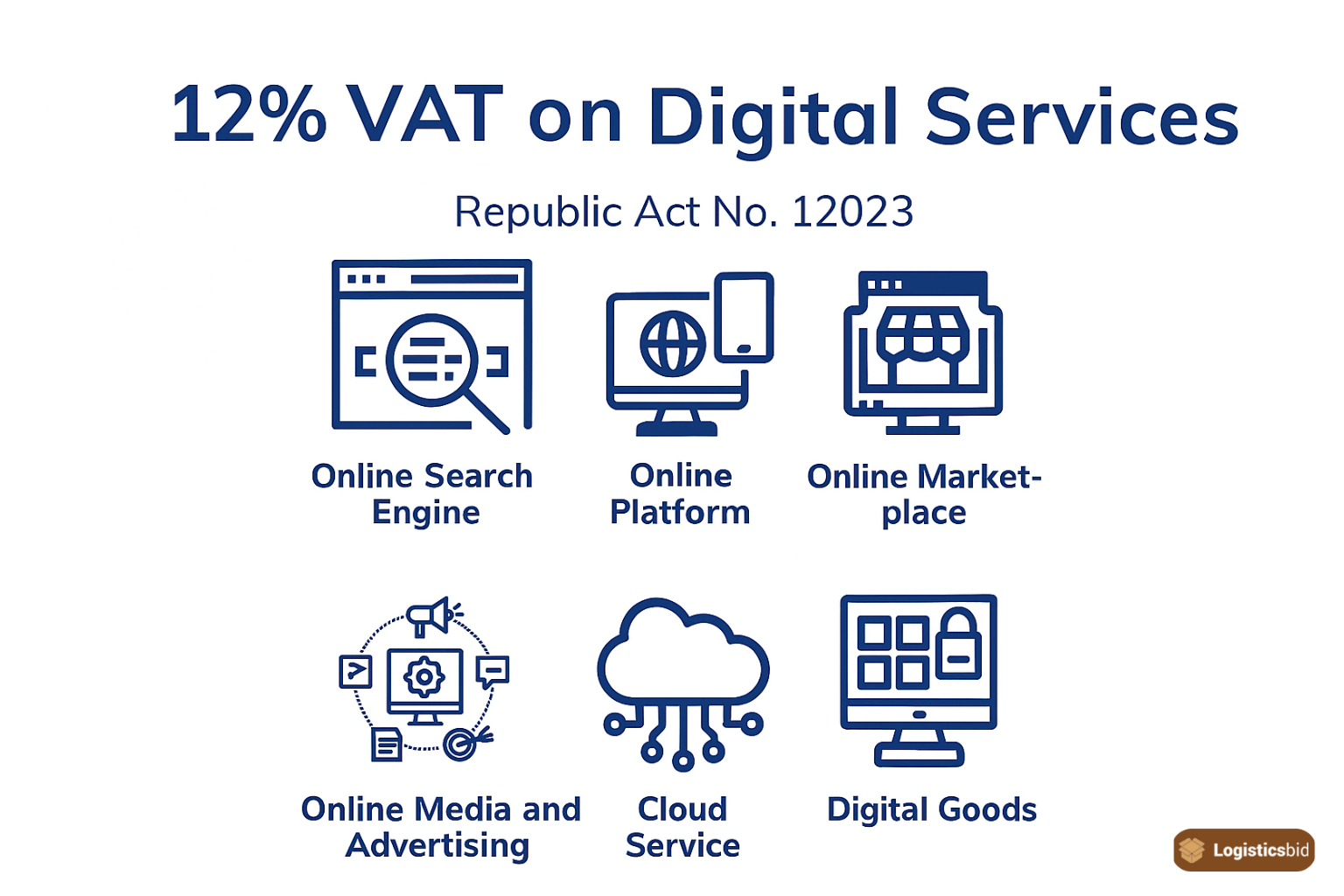

The 12% VAT on digital services, established under Republic Act 12023, requires both local and foreign digital service providers to collect and remit VAT on various services offered to Filipino consumers. This law aims to level the playing field between local and international companies, ensuring that foreign service providers make a meaningful contribution to the Philippine economy. It expands the tax base while aligning with global taxation practices on digital services.

Why the Change?

According to a report by the Bureau of Internal Revenue (BIR), over 60% of Filipinos now access digital services, thanks to rapid internet penetration and a growing economy. With the growth of services such as streaming platforms, online marketplaces, and cloud services, the government recognized the need for a structured tax framework to capitalize on the growth of the digital economy.

Which Services are Affected?

The regulation encompasses a broad range of services, including:

|

1. Streaming Platforms

Services like Netflix, Hulu, and Spotify will now charge an additional 12% on their subscriptions, which will impact the overall cost for users. As consumption of digital media rises—Philippine users streamed over 18 million hours of content in 2022 alone—this additional charge may influence platform pricing structures.

2. Online Marketplaces

Platforms such as Lazada and Shopee, which connect buyers and sellers, are now subject to this law. This means consumers may see slight price increases, which could influence their purchasing decisions.

3. Cloud Computing and Storage Services

Services like Google Drive, Dropbox, and Microsoft Azure will also be subject to digital service VAT. Given that the cloud market in the Philippines is projected to grow to $900 million by 2025, the VAT may further impact pricing strategies for businesses utilizing these services.

4. Digital Advertising Services

Businesses using platforms like Facebook and Google for advertising will have to account for the added 12%, which could lead to potential budget reallocations in marketing strategies.

5. Online Learning and Software Purchases

Educational platforms like Coursera and skill development apps like Udemy will also be subject to digital service VAT, which will influence the affordability of online education.

6. Ride-Hailing Apps

Popular ride-hailing applications, including Grab and Angkas, will now include VAT in their fare computations. As urban mobility solutions evolve, the extra cost can potentially deter users from utilizing these services as frequently.

Implications for Consumers and Businesses

For Consumers

- Cost Increases: The direct consequence of the digital service VAT is a potential increase in subscription fees and service charges.

- Investment in Local Brands: Higher prices on international platforms may lead consumers to explore local or more affordable alternatives.

- Awareness and Adaptation: Users will need to adapt to these changes, exploring budget-friendly options or being more selective with their service subscriptions.

For Businesses

- Compliance Obligations: Companies will now face new compliance burdens in registering with the BIR and implementing VAT systems.

- Increased Operational Costs: Companies may face pressure to absorb digital service VAT costs or pass them on to consumers, which can impact their pricing structure.

- Marketing Strategy Adjustments: To remain competitive in the evolving landscape, businesses may need to revise their marketing budgets and service offerings.

Exemptions to Consider

The new digital service VAT law has identified specific exemptions to alleviate the burden on sectors critical to education and essential services. For example:

Educational services provided by recognized institutions (like TESDA) remain tax-exempt.

Digital banking services provided by accredited banks and financial institutions will also be exempt from VAT imposition.

As the Philippine government implements the 12% VAT on digital services, both consumers and businesses must prepare for a transformative phase in digital consumption. Understanding the implications of this tax will be critical in navigating the digital marketplace landscape effectively.

VAT Compliance Obligations for Digital Service Providers (DSPs) in the Philippines

As the implementation of the 12% VAT on digital services unfolds, digital service providers (DSPs) in the Philippines must be aware of their compliance obligations and the systems established by the Bureau of Internal Revenue (BIR) to facilitate registration and adherence to the new tax regime.

Simplified VAT Registration Portal

The BIR has established a simplified VAT registration portal specifically designed for foreign DSPs. This system is designed to streamline the registration process and reduce administrative burdens, enabling digital service providers to register efficiently without excessive paperwork. Notably, foreign DSPs are not required to appoint a fiscal representative, which significantly simplifies their interaction with tax authorities. This measure is expected to encourage compliance and facilitate foreign investment in the Philippine digital market.

Appointing a Third-Party Service Provider

While a fiscal representative isn’t mandatory, DSPs may opt to appoint a resident third-party service provider, such as a law firm, accounting firm, or consultancy, to assist with various responsibilities, including:

- Receiving Notices: Ensuring that all communications from the BIR are addressed properly.

- Record Keeping: Maintaining records of sales and transactions as required under the VAT regulations.

- Filing Tax Returns: Assisting in the preparation and submission of VAT returns in a timely manner.

- Other Reporting Obligations: Overseeing compliance with any additional reporting requirements imposed by the BIR.

This option provides a practical approach for DSPs to navigate the complexities of tax compliance effectively, particularly those without local expertise.

Compliance with VAT Regulations

One key aspect of compliance involves issuing a digital sales or commercial invoice for every transaction. DSPs are required to ensure that their invoices include specific details, such as:

- Date of Transaction: When the sale or service was completed.

- Transaction Reference Number: A unique identifier for tracking purposes.

- Identification of the Consumer: Relevant consumer identification information to validate the transaction.

- Brief Description of the Transaction: Clarity on what services were provided or sold.

- Total Amount Paid: Clearly state the total amount, inclusive of VAT, to ensure transparency for consumers.

Additionally, the VAT annual sales registration threshold is set at PHP 3 million (approximately €51,400 or $59,500). DSPs must monitor their sales carefully to determine their obligation to register for VAT.

Recent Developments and Financial Expectations

The Department of Finance has indicated that the implementation of VAT on digital services is expected to generate an impressive estimated revenue of PHP 102 billion from 2025 to 2029. This initiative is expected to not only bolster the government’s coffers but also level the playing field for local providers who have long been subject to the existing standard VAT rate of 12%.

Key Takeaways:

The introduction of a 12% VAT on digital services aims to standardize taxation for local and foreign companies.

A wide range of services will be subject to this tax, with impacts spanning various industries.

Consumers may need to adapt to new pricing structures, while businesses must prepare for changes in compliance and operations.

As this tax integrates into the economy, staying informed will empower consumers and businesses alike to make strategic decisions in this digital era.

SEE ALSO: