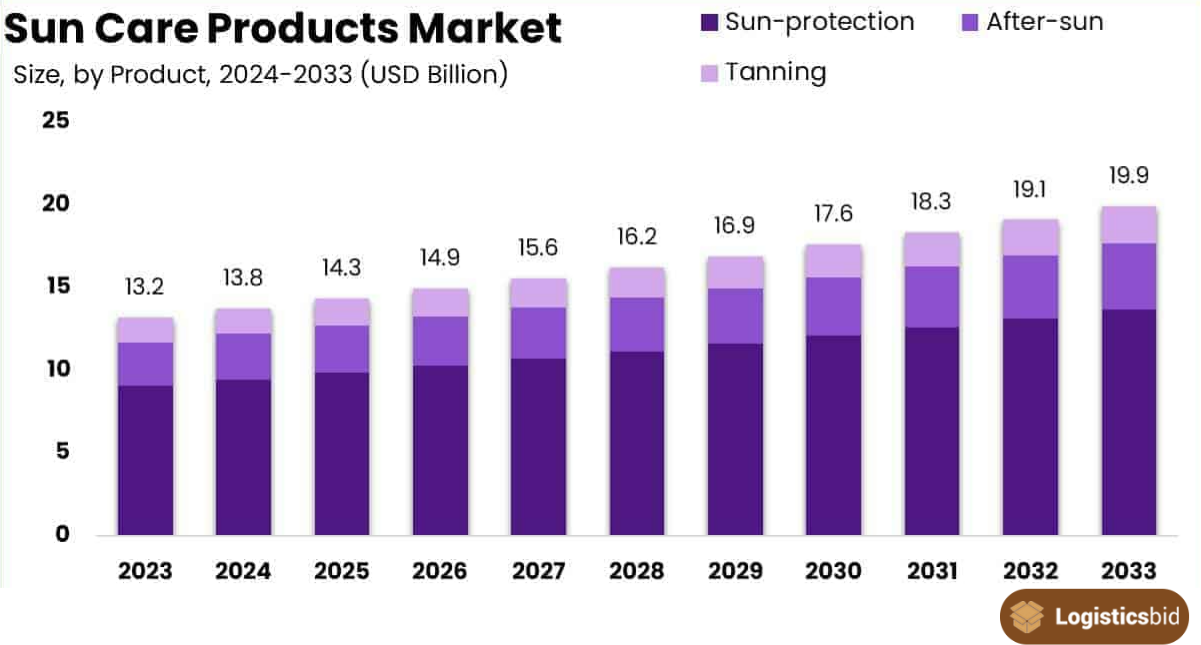

More and more people across Asia and the Pacific are making sunscreen a daily habit and it’s growing that we expect. People are waking up to the fact that sun protection isn’t just for the beach. It’s essential for everyday life. Let’s explore why this is happening and how beauty brands are adapting to meet this demand.

Why Sunscreen is Becoming a Must-Have in the Asia-Pacific Region

Young people across Asia and Australia are taking sun protection more seriously these days. They’re learning about sun damage risks through both educational campaigns and their social media feeds. In fact, social media plays a huge role in their beauty choices – about two-thirds of millennials in the region say they look to social media when buying cosmetics. As these younger consumers put more emphasis on skincare and beauty, sunscreen has become just as essential as any other part of their daily routine.

Multifunctional Products

People want more sun protection, so companies are making products that do double duty. These products combine sun protection with other beauty benefits, giving you a versatile solution. For example, Mebius Pharmaceutical introduced a Simius UV Essence EX in Japan, which combines the functionalities of a sunscreen, serum, and makeup base. Just like how Unilever Malaysia introduced Vaseline Healthy Bright Daily Sun Refreshing Serum, a Malaysian product that not only shields skin from the sun but also hydrates and nourishes it.

Celebrity Endorsements

Celebrities hold major sway over shopping habits in Asia and the Pacific. When beauty brands team up with famous faces, it helps get their products noticed and trusted. This really matters in the region – over half of shoppers there say celebrity endorsements influence what they buy, according to GlobalData.

Targeted Solutions for Sensitive Skin

Targeted cosmetic treatments, particularly those designed for delicate skin, are preferred by APAC consumers. This pattern demonstrates the growing need for niche, mission-driven goods in the multipurpose cosmetics market. When purchasing beauty and grooming products, consumers tend to equate “good value for money” with high-quality products and components that have several benefits and functions.

The Importance of Personalization

People in Asia Pacific are getting more serious about sun protection, but they still want sunscreens that look and feel good. Companies that make sunscreens that cater to different tastes and find new ways to protect skin will likely thrive in this market.

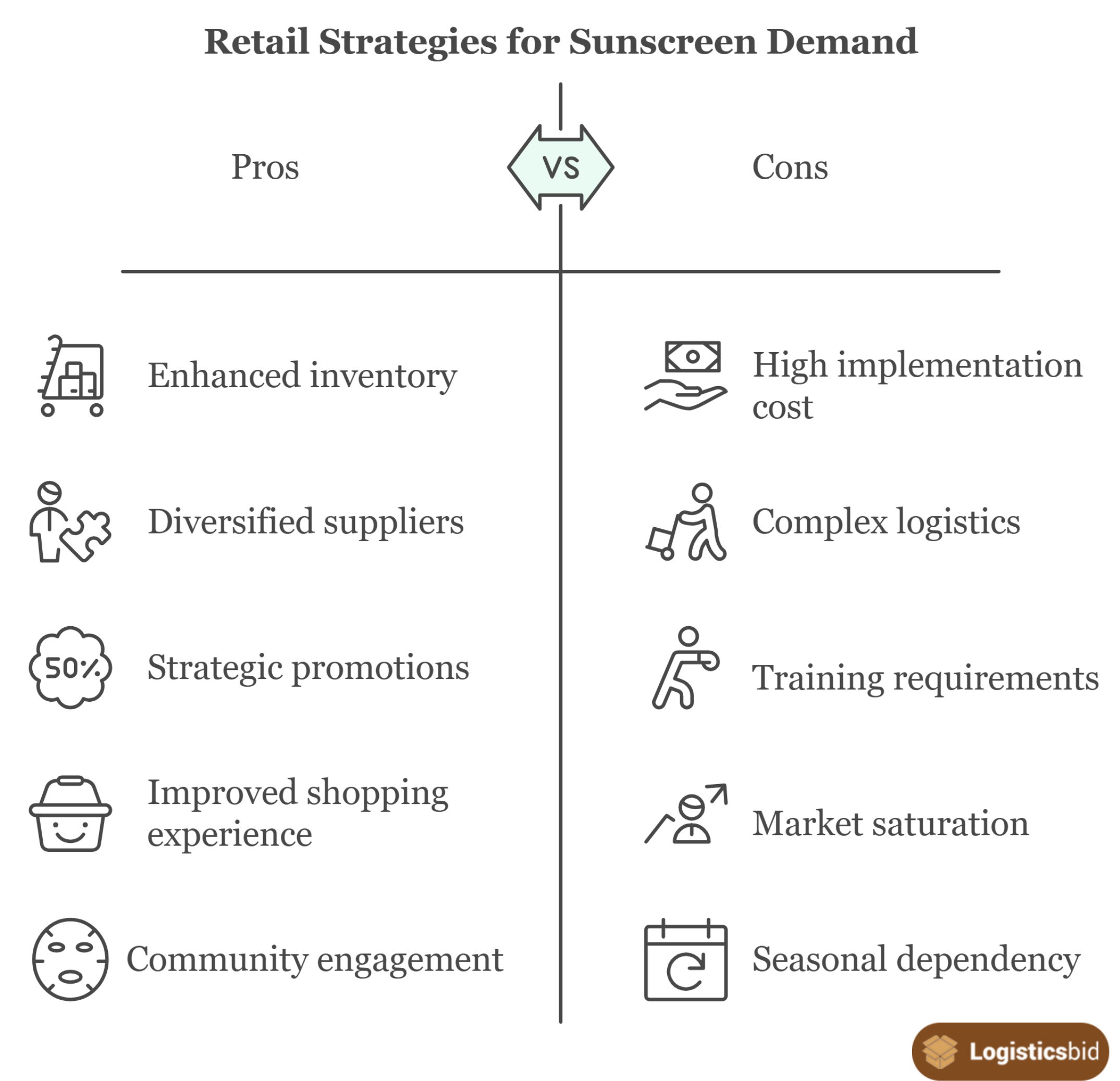

Smart Shopping: How Retailers are Adapting to the Surge in Demand

Filipino retailers are finding smart ways to keep up with the growing sunscreen demand across Asia. They’re making it easier for shoppers to find and buy sun protection products, especially during the busy holiday rush. By keeping shelves stocked and engaging with customers, they’re tapping into the region’s increasing focus on sun care.

Enhanced Inventory Management

Retailers are leveraging sophisticated inventory management systems that allow for real-time tracking of stock levels and automated replenishment. This technology enables them to keep popular sunscreens in stock, preventing shortages during peak shopping times and responding swiftly to any changes in consumer demand.

Diversified Supplier Networks

To mitigate risks associated with supply chain disruptions, especially in a region prone to seasonal storms and logistical challenges, retailers are diversifying their supplier networks. This includes partnering with multiple distributors and manufacturers to ensure a consistent supply of products. Such diversification also allows retailers to offer a wider range of sunscreens, catering to various consumer preferences and skin types.

Strategic Promotions and Discounts

Stores are ramping up their holiday deals to stand out from the crowd. They’re putting together combo deals like pairing sunscreen with makeup, and running limited-time sales to get shoppers to buy sooner rather than later.

Enhanced Shopping Experience

Stores are making it easier to shop for sunscreen, whether you’re browsing online or in person. Websites now have clear descriptions, helpful reviews, and simple menus to help you find exactly what you need. If you prefer shopping in stores, the staff there are better trained to give you personal advice and help you choose the right product.

Community and Educational Initiatives

Beyond sales, retailers are engaging in community outreach and educational initiatives to raise awareness about the importance of sun protection. These efforts include hosting skincare seminars, collaborating with dermatologists to provide expert talks, and distributing free samples in high-traffic areas, such as malls and beaches, during the holiday season.

The Logistics of Sun Care: Keeping Up with the Holiday Rush

With more people in Asia-Pacific buying sunscreen, especially during holidays, beauty brands need better ways to get their products to stores. The busy shopping season is a great time for companies to improve how they deliver sunscreen to retailers across the Philippines.

Strategic Distribution Centers

In the Philippines, strategically placing distribution centers in strategic areas can drastically cut down on delivery times and guarantee that shops have easy access to sunscreens and other cosmetics during periods of high demand. To manage huge product volumes and enable prompt replenishment of in-demand commodities, these facilities ought to be outfitted with cutting-edge inventory management systems.

Robust Supply Chain Partnerships

Maintaining a smooth supply chain requires working with trustworthy logistics partners, particularly during the Christmas season when demand peaks unanticipatedly. Businesses should collaborate with logistics companies that provide scalable and adaptable services so they can respond to unexpected spikes in demand without sacrificing product safety or delivery time.

Advanced Forecasting Tools

Utilizing advanced forecasting tools can greatly aid in predicting demand fluctuations, particularly during holidays and promotional periods. These tools help companies anticipate market needs, optimize inventory levels, and prevent stockouts or overstock situations, ensuring a steady supply to retailers without excess holding costs.

Efficient Transportation Solutions

Investing in efficient transportation solutions, such as GPS-enabled transport vehicles, can enhance delivery efficiency. These solutions not only provide real-time tracking but also help in route optimization, reducing delays caused by traffic congestion, which is common during the holiday rush in the Philippines.

E-commerce Integration

Given the significant shift towards online shopping, integrating e-commerce capabilities with traditional retail strategies is crucial. Providing a direct-to-consumer shipping option through a robust e-commerce platform can supplement physical retail distributions and cater to a broader audience, maximizing product availability and consumer convenience.

Responsive Customer Service

Maintaining a responsive customer service system during the holiday season helps in addressing retailer concerns promptly, ensuring that any logistical issues are resolved swiftly to avoid disruptions in the supply chain. This level of support strengthens retailer trust and can enhance long-term partnerships.

Conclusion

Due to growing awareness of the dangers of sun exposure and the impact of social media, there is a growing demand for sunscreen in the APAC area. In response to this need, cosmetics businesses are collaborating with celebrities to increase the visibility and legitimacy of their goods and providing multipurpose items. Furthermore, customers in the area like customized cosmetics that complement their aesthetic objectives and favor focused remedies for delicate skin. Brands that can meet these demands are well-positioned to succeed in the growing APAC suncare market.

In conclusion, as the demand for sunscreens in the APAC region grows, particularly during the high-stake holiday season, it is imperative for cosmetics companies to employ strategic logistics and delivery solutions. These measures not only ensure that products reach retailers efficiently and on time but also enhance overall customer satisfaction, which is critical for maintaining competitive advantage in the dynamic APAC market.