Global logistics networks are again under strain as the 2025 holiday season approaches. According to the Dimerco Express Group’s Asia Pacific Freight Report for November 2025, shippers across Southeast Asia and India are being advised on early booking and plan ahead, as port congestion and holiday shipping capacity limits begin to tighten. Rising seasonal demand, fluctuating fuel prices, and ongoing geopolitical uncertainties are compounding freight cost volatility.

This marks a critical phase for businesses in export-driven economies such as the Philippines, Vietnam, Malaysia, and India, where manufactured goods and consumer products surge toward North American and European markets in the final quarter of the year.

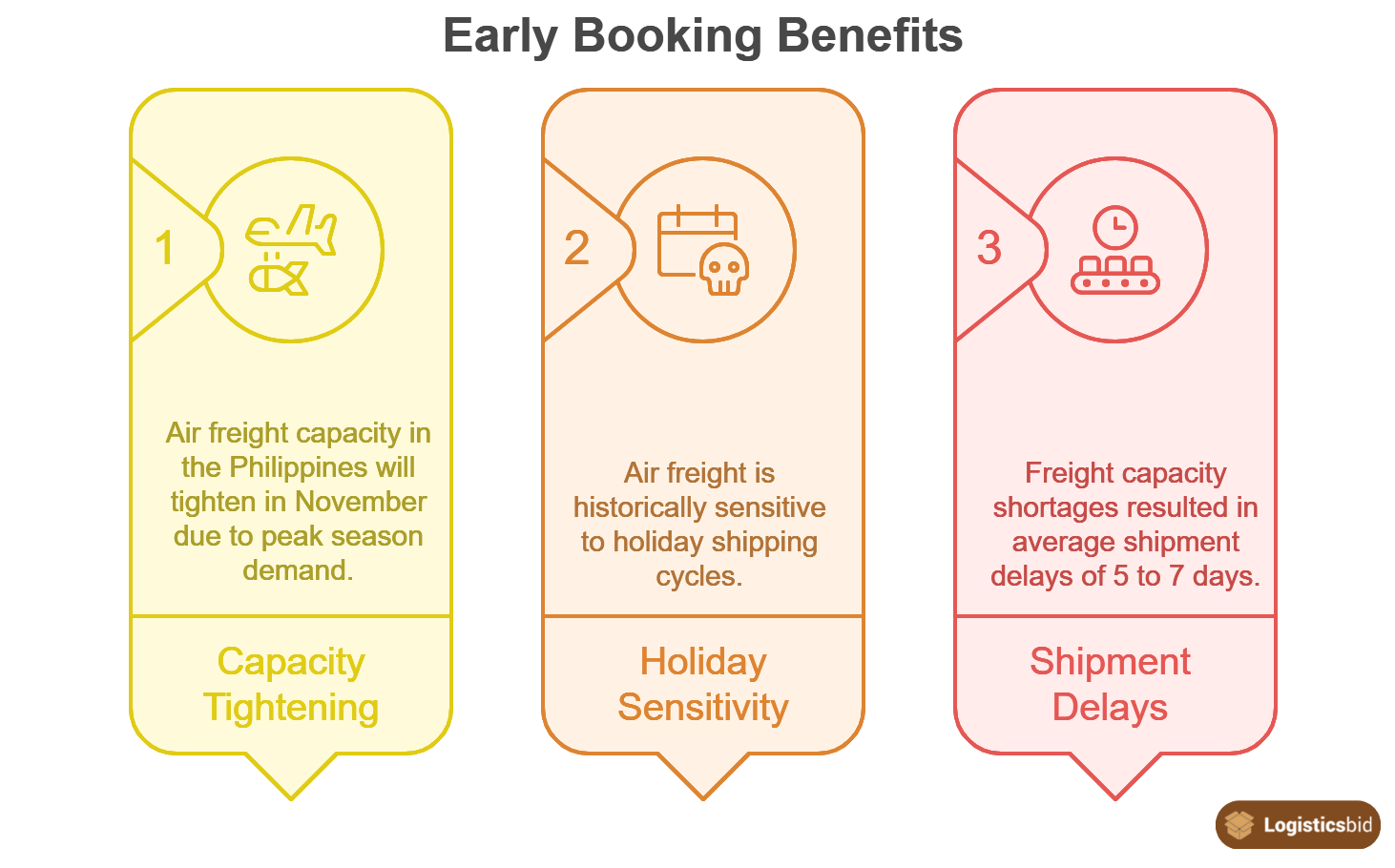

Why Early Booking Is Now Essential

Dimerco’s report highlighted a crucial forecast, that air freight capacity in the Philippines will tighten in November due to peak season demand. The report warns shippers, particularly those transporting retail, consumer goods, electronics, and perishables, to arrange space well in advance to avoid costly last-minute surcharges.

|

Air freight in the region has been historically sensitive to holiday shipping cycles, especially around Black Friday, Cyber Monday, and Christmas. The Philippine Exporters Confederation (PhilExport) noted in 2024 that freight capacity shortages resulted in average shipment delays of 5 to 7 days, draining the margins of small-to-medium exporters.

Sea Freight: Mounting Demand Meets Limited Equipment

While sea freight remains the most cost-efficient mode for bulk cargo, the current trend shows equipment and vessel space tightening across Philippine ports. The elevated freight rates for Philippine goods bound for the United States and European Union, as noted in Dimerco’s report, signal strong outbound demand but also potential bottlenecks.

According to data from the International Chamber of Shipping (ICS) , rates in regional maritime routes can jump up to 20–30% during peak periods, primarily due to limited container availability and rising fuel costs.

A Ripple Effect on Supply Chains

Once cargo buildup starts at ports like Manila International Container Terminal (MICT) and Cebu International Port, downstream logistics, from trucking to warehousing, experience cascading congestion. For time-sensitive commodities such as electronics or apparel, even slight delays can translate to contract penalties and inventory mismatches for retailers abroad.

Air Freight Trends: A Shift Driven by High-Tech and E-Commerce

The Transpacific Rush

The global logistics firm pinpointed several forces behind the 2025 surge in Asian air exports to North America. Chief among them is the shortage of aluminum coils in the U.S. , which has accelerated import demand. Added to this are new high-tech product launches, global logistics of e-commerce promotions, and the momentum of Amazon’s pre–Black Friday cut-off date of November 13.

Data from IATA (International Air Transport Association) reveal that air cargo demand rose 8.2% year-over-year across the Asia-Pacific corridor as of late 2025, a significant rebound from 2023 levels when carriers struggled with post-pandemic underutilization.

The Ocean-to-Air Shift

The Dimerco report also pointed to “blank sailings”, deliberate cancellations of ocean freight routes by carriers, that are pushing shippers toward faster, though costlier, air freight alternatives. According to Freightos’ Global Freight Index (2025) , air freight rates from Asia to North America are up nearly 18% since October, an indicator of mounting urgency among shippers.

Geopolitical and Tariff Implications

The US-China Tariff Pause

Another key driver affecting freight dynamics is the temporary suspension of U.S.-China tariffs, which was in place until November 12, 2025. This policy development, albeit temporary, created an incentive for manufacturers and export houses to “front-load” shipments to beat potential tariff reinstatements.

Dimerco’s Vice President for Global Sales and Marketing, Kathy Liu, noted that this front-loading effect will continue to shape air export demand through mid-November. She emphasized the importance of monitoring trade negotiations and ocean freight capacity closely, as both elements will influence logistics planning toward year-end.

The Waiting Game for Importers

For the ocean freight sector, Ted Chen, Dimerco’s Director for Ocean Freight Global Sales and Marketing, remarked that many importers have adopted a “wait-and-see” approach after restocking earlier in the year. The upcoming months will reveal whether the market rebounds in early 2026 or slides into a capacity lull depending on tariff outcomes and geopolitical developments.

Strategic Takeaways for Shippers

Early Booking and Stay Competitive:

Anticipate surges in demand and secure bookings at least 3–4 weeks ahead of departure.

Diversify Freight Options:

Combine air and sea freight depending on the product’s shelf life, urgency, and customer commitments.

Monitor Geopolitical Trends:

Keep a close eye on trade policy changes, especially those between the U.S., China, and ASEAN corridors, which can either dampen or accelerate freight flows.

Leverage Data Analytics:

Integrate predictive analytics into supply chain planning to detect congestion patterns for early booking and make more informed routing decisions.

The Role of E-Commerce and Consumer Electronics

With e-commerce giants like Amazon, Shopee, and Lazada leading seasonal promotions, the pull on logistics networks intensifies. According to Statista (2025) , e-commerce cross-border shipments from Southeast Asia are projected to grow over 14% year-on-year, with electronics, apparel, and accessories dominating export categories.

This explains why air freight volumes have spiked alongside product launches from major tech firms such as Apple, Samsung, and Huawei—especially when consumer pre-orders intersect with U.S. retail promotions. Shippers catering to these sectors must synchronize logistics cycles with global logistics marketing calendars to prevent bottlenecks.

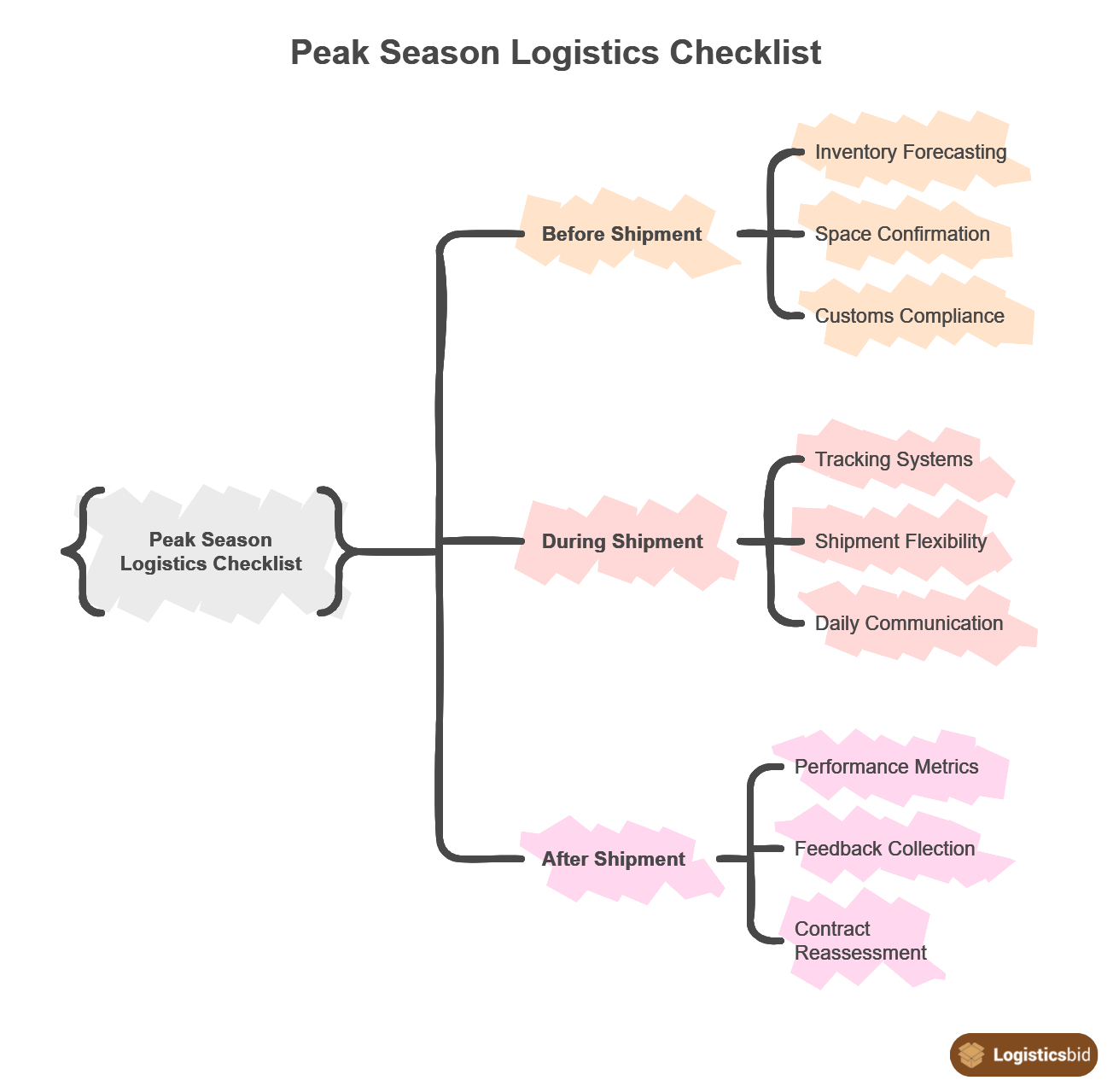

Tactical Advice: Practical Checklist for Peak Season Success

|

Before Shipment

- Prioritize inventory forecasting based on demand data from past years.

- Secure space confirmation three weeks earlier than usual peak timelines.

- Confirm compliance with destination customs regulations to avoid clearance delays.

During Shipment

- Utilize end-to-end tracking systems for transparency.

- Maintain flexibility, split shipments into different modes where necessary.

- Communicate with freight forwarders daily during critical cut-off windows.

After Shipment

- Evaluate logistics performance metrics such as on-time delivery rate (OTDR).

- Gather feedback from receivers for continuous improvement.

- Reassess transportation contracts for the next cycle based on lessons learned.