Warehouse demand in the Philippines surged by 80% in the first half of 2025, marking a remarkable rebound driven by growing needs in wholesale and retail, logistics, and manufacturing sectors. This article explores key statistics, market regions, and emerging patterns shaping the country’s industrial real estate landscape, based on the latest outlook by PRIME Philippines.

What Is Driving the Warehouse Demand Surge?

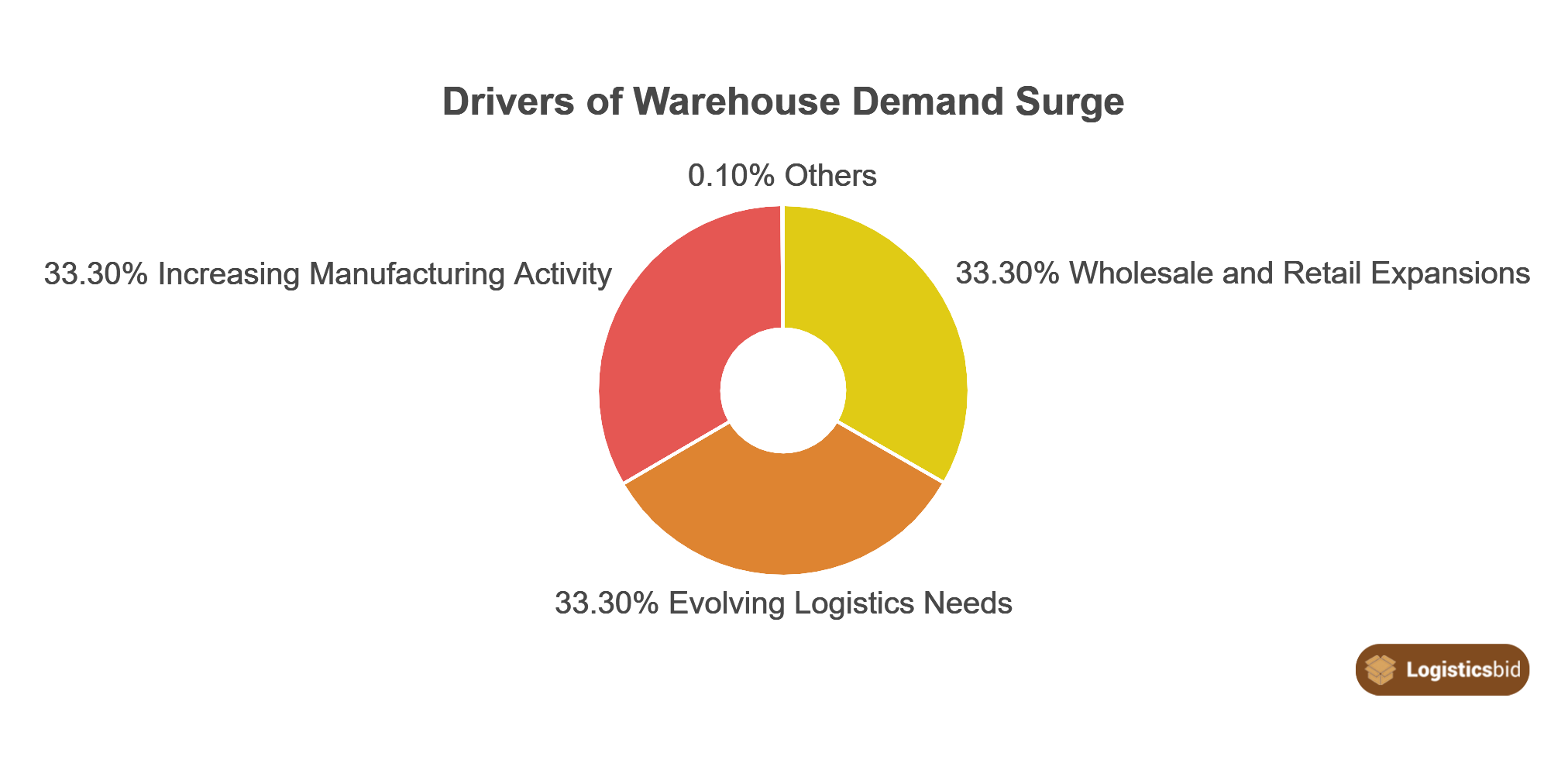

The jump to 691,900 sqm in demand from the previous period highlights a critical shift in supply chain management. According to PRIME Philippines, the growth is primarily fueled by:

- Wholesale and retail expansions

- Evolving logistics needs, particularly for e-commerce fulfillment

- Increasing manufacturing activity, including green technology production

Recent research by industry experts indicates that companies are consolidating operations, seeking larger and strategically located nationwide warehouse spaces to meet complex consumer demands. With an average occupancy rate of 94%, and Cebu peaking at 98%, there is a clear indication that market fundamentals remain robust and highly competitive.

Key Insights:

- Over 80% surge in demand emphasizes the resilience of domestic supply chains.

- Nationwide warehouse expansion continues to respond to cyclical peaks, especially in the first and last quarters.

- Increasing requests for premium-grade nationwide warehouses support sustainability and operational efficiency.

How Does the Supply Side Respond?

The supply side has grown significantly alongside demand. In the first half of 2025, the nationwide warehouse demand stock increased by roughly 1.5 million sqm, supporting a 3.7% overall growth. Several strategic developments across Luzon and other regions are noteworthy:

Major Supply Developments

- Tarlac: Strategic projects in Tari Estates and New Clark Estates are setting the tone for future expansion.

- Pampanga: Notable projects in Mabalacat and Angeles benefit from excellent connectivity via the North Luzon Expressway and MacArthur Highway.

- Bulacan: Bocaue and Sta. Maria are attracting redevelopment due to proximity to Metro Manila while mitigating natural risks.

These developments indicate that while supply is growing briskly, most lease rates remain stable within a 0% to 2% range, barring outliers like Pampanga and select facilities in Laguna.

Which Sectors Are the Primary Demand Drivers?

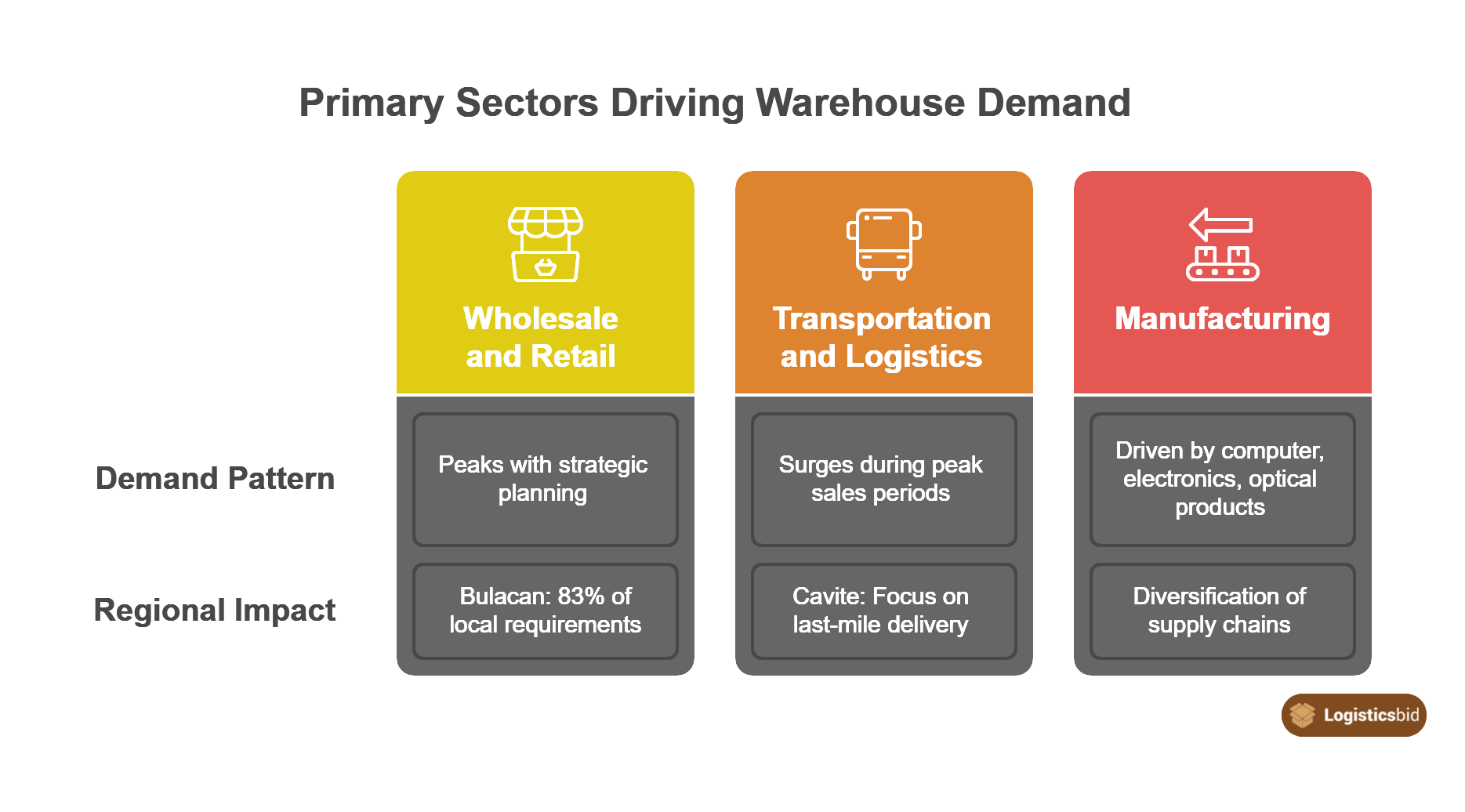

A closer look at the demand mix reveals that three primary sectors underpin the nationwide warehouse demand surge:

Wholesale and Retail

Demand here consistently peaks in alignment with long-term strategic planning cycles.

In Bulacan, the retail sector comprised nearly 83% of local requirements, reflecting the area’s importance as a logistics hub for Metro Manila-based retailers.

Transportation and Logistics

Both third-party logistics (3PL) providers and e‑commerce companies have intensively sought warehouse demand space to manage inventory surges during peak sales, especially during holidays and annual sales periods.

Prime logistics regions like Cavite have evolved, shifting focus from manufacturing to integral last‑mile delivery centers.

Manufacturing

A notable 81,000 sqm requirement from sectors such as computer, electronics, and optical product manufacturing has been reported.

Emerging trends in green technology, such as solar components, electric vehicle batteries, and energy systems, are signaling the advent of a broader tech manufacturing expansion.

Academic research and industry forums, including presentations by PRIME Philippines’ assistant vice president Joy Rosario-Bautista, underscore that diversification of supply chains in response to US-China trade tensions has also accelerated demand for warehouses in the country.

What Are the Market Trends and Future Projections?

Analysts forecast that the total nationwide warehouse supply in the Philippines could hit 41.5 million sqm by 2028, with strategic pipeline projects in Tarlac and North Luzon driving growth. The market is also witnessing:

A rhythmic, cyclical demand pattern, with peaks in the first and last quarters of the year.

Increased consolidation as tenants shift away from dispersed networks toward strategically located, high-grade warehouses.

The emergence of new hotspots such as Liloan and Consolacion promises to alleviate saturation from central nodes like Mandaue.

Industry experts note that this growth not only underscores the structural soundness of the Philippines’ warehousing market but also highlights the country’s potential as an emerging hub for clean, export-oriented industrial activities in Southeast Asia.

Practical Implications for Stakeholders

For investors and developers, the convergence of rising demand and stable lease rates suggests a balanced risk-reward structure. Practical recommendations include:

Prioritizing investments in regions with strong connectivity, such as Bulacan, Pampanga, and Tarlac.

Focusing on premium-grade warehousing that meets modern operational standards and sustainability requirements.

Leveraging cyclical demand patterns to optimize leasing strategies, especially in anticipation of high-demand quarters.

Manufacturers and logistics providers are advised to consider regional consolidation strategies to enhance operational efficiency and reduce transport inefficiencies, a strategy increasingly endorsed by global supply chain leaders under the China+1+1 paradigm.

Conclusion and Next Steps

The 80% jump in warehouse demand in the Philippines within just the first half of 2025 reflects robust market dynamics underpinned by strategic sector shifts and regional developments. As supply continues to grow, maintaining high occupancy rates and steady lease rates suggests excellent market resilience.

Key Takeaways:

A multifaceted demand mix from retail, logistics, and manufacturing sectors drives the surge.

Regional growth in areas like Bulacan, Pampanga, and Tarlac provides both opportunities and challenges due to evolving market dynamics.

Future investments should focus on premium-grade and strategically located warehouses to meet the evolving needs of e‑commerce and global manufacturing trends.

Stakeholders are encouraged to monitor upcoming projects and regional trends closely. By aligning strategic investments with these evolving patterns, both investors and industry players can capitalize on the burgeoning growth in the Philippine industrial real estate market.

For more detailed insights and market forecasts, industry reports, and presentations by experts such as Joy Rosario-Bautista from PRIME Philippines provide invaluable information for decision-making in this dynamic landscape.