The Sugar Regulatory Administration (SRA) of the Philippines has undertaken significant regulatory amendments to address concerns regarding unregulated sugar industry imports. Stakeholders have raised long-standing issues about the unmonitored entry of various sugar types, prompting the SRA to expand its import regulations oversight.

Sugar Regulatory Administration (SRA) Responds to Industry Concerns

Amendment to Sugar Order No. 03: A New Era of Sugar Import Regulations

The implementation of Sugar Order (SO) No. 06, dated November 18, 2023-2024, marks a critical update to SO No. 03 from 2016-2017. The original order covered only fructose; however, the new directive now encompasses a broad spectrum of sugars, sweeteners, and sugar-based products, all subject to stricter import regulations controls.

Expanded Coverage Under SO No. 06

Under the revised SO No. 06, the following products are now regulated:

- Sugars: Includes sucrose, specialty sugars, and flavored syrups classified under Heading 17.01 of the AHTN.

- Other Sugars: Fructose, lactose, glucose, and maple syrup fall under Heading 17.02.

- Sugar Confectionery: All items within Heading 17.04, such as candies and other sugar-based goods.

However, raw and refined sugar, along with other specific Chapter 17 items, remain exempt as they are governed by separate SRA directives. The requirements for application of clearance of release of the covered imported goods under SO No. 6 are the same as those required by SO No. 03 and SO No. 04, except for the addition of packing list and commercial invoice.

New Compliance and Clearance Processes

The clearance application requirements have remained largely unchanged but now include additional documentation:

- Packing list

- Commercial invoice

The clearance fees are as follows:

- General sugars: P3 per 50-kilo bag (P60 per metric ton).

- Fructose: Retains the existing fee of P30 per 50-kilo bag.

Storage and Classification Adjustments

The updated regulation introduces key changes to product classification and storage mandates:

- Products must be stored in SRA-registered warehouses instead of customs bonded facilities.

- Classification is designated as:

- B: Domestic market

- C: Reserved

- D: World market

Only items classified as “B” or “D” can leave the registered storage facilities for consumption or export.

Monitoring and Penalties

To ensure adherence, the SRA requires importers to notify the Regulation Department in advance of any movement of classified “C” products. Non-compliance results in penalties per Sugar Orders No. 10 and 10-A, with additional legal actions where necessary.

Industry Implications

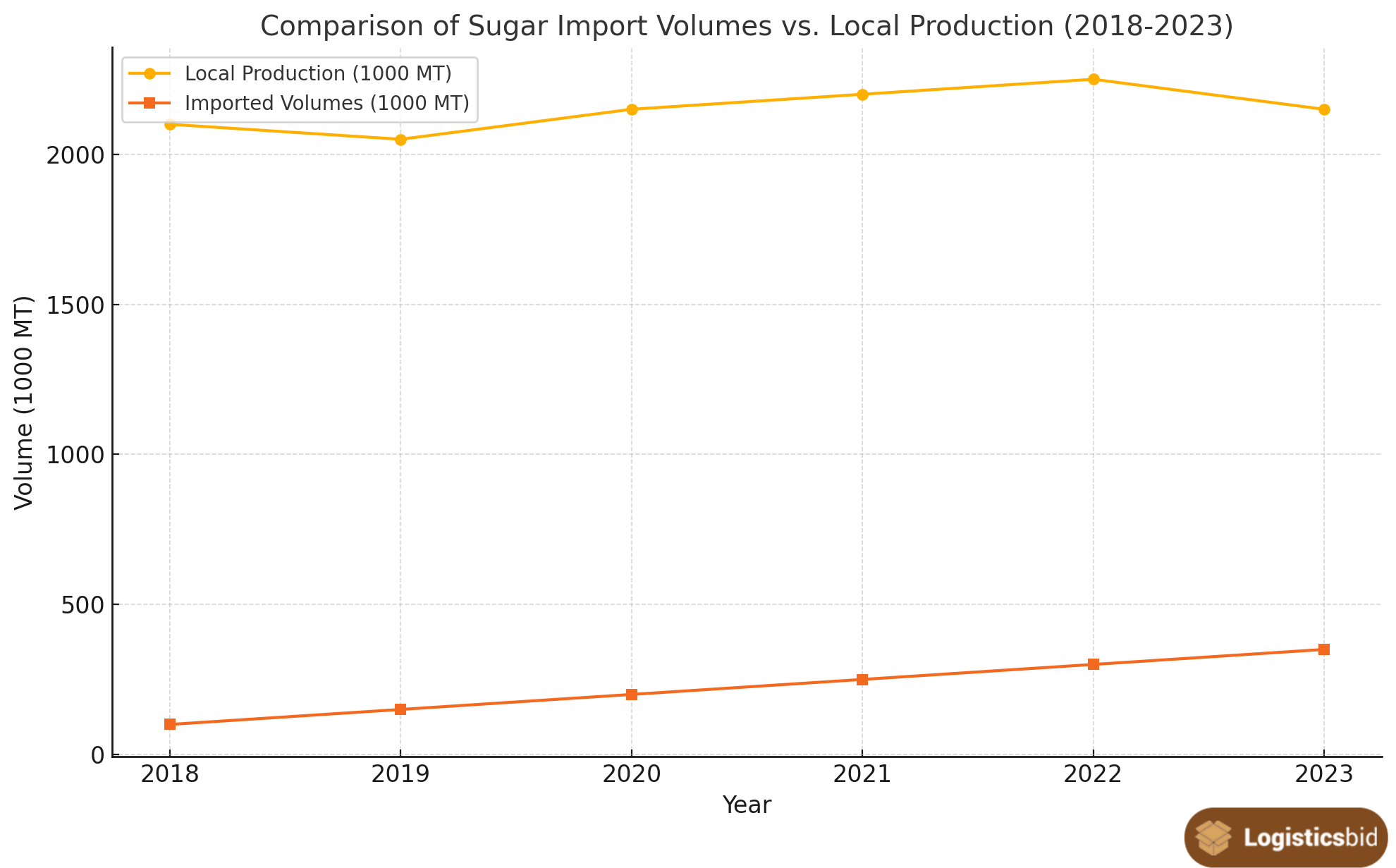

The expansion aims to protect local industries by addressing loopholes exploited by unregulated imports. According to SRA data, sugar production in the Philippines contributes significantly to the agricultural sector, with over 2 million metric tons of annual output.

The comprehensive regulatory updates reflect the SRA’s commitment to balancing domestic industry protection and compliance with international trade norms. This shift ensures fairness while addressing long-standing industry concerns.

Economic Impacts of Expanded Sugar Import Regulations

Supporting Local Producers

The broader import regulation serves to safeguard domestic sugar producers, addressing a key concern about market competition from cheaper imports. The Philippine Sugar Regulatory Administration (SRA) has emphasized the need to protect the 30,000+ smallholder farmers and sugar mill workers that drive the sector.

Potential Price Adjustments

With stricter import controls, local markets might experience adjustments in sugar and sweetener prices. According to recent industry estimates, sugar industry accounts for about 15-20% of production costs in food manufacturing. A regulated market could stabilize prices but might also increase costs for manufacturers relying on imported ingredients.

Revenue Implications

The introduction of a standardized clearance fee (e.g., PHP 60/MT for sugars) could generate significant revenue for the SRA, which can be reinvested into regulatory enforcement and sectoral development initiatives.

Industry Challenges and Compliance Considerations

Warehousing and Logistics

The requirement for SRA-registered warehouses introduces logistical adjustments for importers. For companies managing bulk imports, this could mean re-evaluating supply chain strategies to meet compliance timelines.

Classification Restrictions

The classification of goods into “B,” “C,” and “D” markets poses additional administrative hurdles. For instance:

- “C” Classification: Products can only be stored until reclassified for domestic or export markets.

- Impact on Food Manufacturing: Delays in reclassification could disrupt manufacturing operations dependent on these ingredients.

Key Figures in the Sugar Industry

Production Statistics

The Philippine sugar industry produces approximately 2.1 million metric tons annually, catering to both domestic and export markets. The new regulations could directly influence this output by fostering a more competitive environment for local producers.

Import Trends

In 2023, the Philippines imported around 150,000 metric tons of fructose and other sugars, with a significant portion used in food and beverage manufacturing. The expanded coverage under SO No. 06 could affect these figures in the coming years.

The SRA’s move to expand sugar import regulations is a significant step toward ensuring fairness and protecting the domestic sugar industry. While challenges exist, the regulations also open opportunities for modernizing supply chain practices and enhancing the competitiveness of Philippine sugar industry products on a global scale.