With SMEs representing approximately 90% of all businesses and contributing significantly to employment and GDP, understanding SME business trends allows more opportunities and makes more businesses thrive along with time and innovations.

What Is the Economic Environment for SME Businesses Today?

The economic environment in the Philippines is seen with significant growth and resilience, particularly in the wake of the challenges posed by the COVID-19 pandemic and other economic problems that the Philippines experienced for the past years. From 2012 to 2019, the country experienced robust real GDP growth ranging from 6% to 7% annually.

|

After the pandemic, the economy recovered in 2022 at the fastest rate of growth since 1976, with annual increases in gross capital formation of 16.8% and annual increases in household final consumption expenditure of 8.3%.

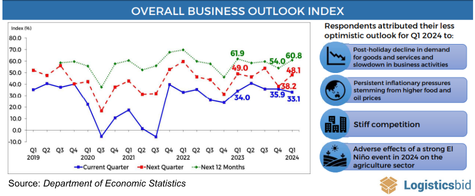

Expansionary conditions continued as of late 2023, as seen by an increase in the S&P Global Philippines Manufacturing PMI, which hit its highest level since February. On the other hand, the economy is confronted with obstacles such as elevated rates of joblessness, projected inflation rates of 5.1% by 2023, and the weakening value of the Philippine peso in relation to the US dollar.

The outlook for economic growth is still favorable despite these challenges; 6.0% GDP growth is anticipated in 2023 and 6.2% growth in 2024, mostly due to domestic demand and a rebound in the services sector, especially tourism. Through a number of programs, such as the Magna Carta for MSMEs, the Philippine government has been actively assisting micro, small, and medium-sized enterprises (MSMEs) by expanding their access to capital and market prospects.

What Are the Emerging SME Business Trends?

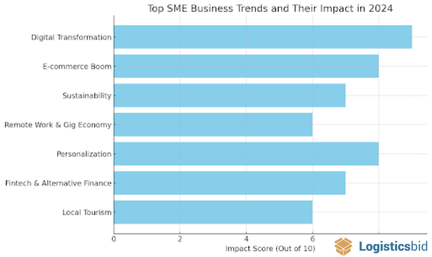

New opportunities are presented to MSMEs by emerging SME business trends like digital transformation, but these changes also bring with them new problems that firms need to overcome. The future of SMEs in the Philippines will be significantly shaped by the general economic environment, which is impacted by both domestic and international variables. To address problems like inflation, employment, and market competitiveness, a multimodal strategy would be needed.

|

-

Digital Transformation

Digital transformation is increasingly recognized as a crucial component for the success of small and medium enterprises (SMEs) in the Philippines. According to Alfredo Pascual, president of the Institute of Corporate Directors, SMEs must embrace digital transformation to capitalize on opportunities in the evolving digital economy. He emphasizes that businesses that fail to adapt risk being left behind in a competitive landscape driven by technological advancements.

-

E-commerce and Digital Payments

The rise of e-commerce continues to reshape how small medium enterprises do business. In 2024, more consumers are expected to prefer online shopping, pushing SMEs to invest in digital platforms, secure payment gateways, and strong online presence. Businesses that integrate seamless e-commerce experiences are likely to capture a larger market share.

-

Sustainability as a Differentiator

Sustainability has moved from a trend to a necessity, with eco-conscious consumers prioritizing brands that embrace green practices. SMEs that adopt sustainable operations, such as reducing carbon footprints or using recyclable materials, will not only appeal to consumers but also cut operational costs in the long run.

-

The Rise of Remote Work and the Gig Economy

Post-pandemic, remote work and flexible arrangements have become permanent fixtures. The gig economy is flourishing, with many workers opting for freelancing and short-term contracts. SMEs that embrace hybrid work models and tap into freelance talent pools will be better positioned to adapt to workforce shifts.

-

Personalization and Custom Experiences

Customer expectations for personalized services are rising. SMEs must harness data analytics to offer tailored experiences, which can range from personalized product recommendations to targeted marketing messages. By improving personalization like in business logistics, businesses can enhance customer loyalty and differentiation from competitors.

-

Fintech and Alternative Financing

Access to traditional financing remains a challenge for many SMEs. In response, fintech and alternative financing solutions have become more accessible. These platforms offer faster, more flexible financing options, empowering businesses to seize growth opportunities or manage cash flow more effectively.

- Focus on Local Tourism

With global tourism still recovering, local tourism is gaining momentum in the Philippines. SMEs in the hospitality and tourism sectors are benefiting from increased government support and a surge in domestic travel. This focus on local tourism presents significant growth potential for businesses in these industries.

These SME business trends highlight the need for SMEs to be agile, tech-savvy, and customer-centric to thrive in 2024. By embracing digital tools, fostering sustainable practices, and adopting flexible work models, businesses can stay competitive and capitalize on emerging opportunities.

PhilSME Business Expo 2024: Connecting with Emerging Trends

As the 15th edition of the Philippine SME Business Expo approaches on November 22-23, 2024, it offers a prime platform for businesses to engage with over 8,000 attendees, including SMEs, entrepreneurs, and industry leaders.

This event is pivotal for SMEs to explore SME business trends such as Digital Transformation, Sustainability, and E-commerce. With over 180 business solutions and 30 keynotes, the expo aligns with the ongoing SME business trends for 2024, offering real-time insights into the evolving market.

Learn more about the event on their website: Expand Your Reach: Connect with Industry Leaders.

For SMEs, participation in such expos is an excellent way to stay competitive and gain firsthand knowledge on topics like AI integration and alternative financing, critical for navigating the year ahead.